Rockhurst University

Gifts of Life Insurance

Make a significant gift to Rockhurst University even without a large estate. Here's how you can leverage your dollars for a larger gift.

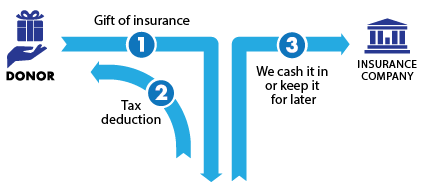

How It Works

- You transfer ownership of a paid-up life insurance policy to Rockhurst University.

- Rockhurst University elects to cash in the policy now or hold it.

- Consider naming Rockhurst University in your long-term plans. It's simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

Next

- Frequently asked questions on gifts of life insurance.

- Contact us so we can assist you through every step.